39 sales tax discount math worksheets

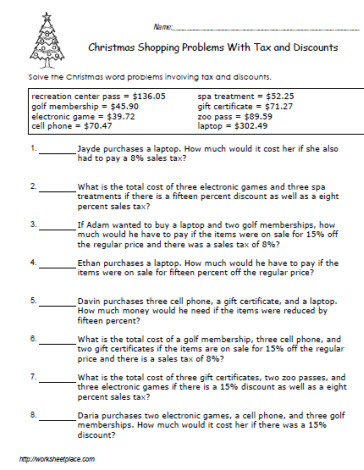

Discount And Tax Worksheets - K12 Workbook Displaying all worksheets related to - Discount And Tax. Worksheets are Sales tax and discount work, Sales tax and discount work, Discount tax and tip, Markup discount and tax, Percents markup discount and tax hard, Markup discount and tax, Sales tax practice work, Discount markup and sales tax. *Click on Open button to open and print to worksheet. Discount & sales tax worksheet - Liveworksheets.com Discount & sales tax worksheet. Live worksheets > English. Discount & sales tax. Students will be given a scenario and then asked to calculate the discount, sale price, tax and total cost. ID: 3005084. Language: English.

Tax Tips And Discounts Maze 1 Answer Key - myilibrary.org Sales Tax, Tips And Discounts Game: Math Maze. Sales Tax, Tips and Discounts Game: Math Maze Subject: Mathematics Age range: 11 - 14 Resource type: Visual aid/Display 0 reviews File previews png, 92.07 KB png, 92.93 KB pdf, 193.14 KB This maze is a great way for students to practice their skills with sales tax, tips and discounts.

Sales tax discount math worksheets

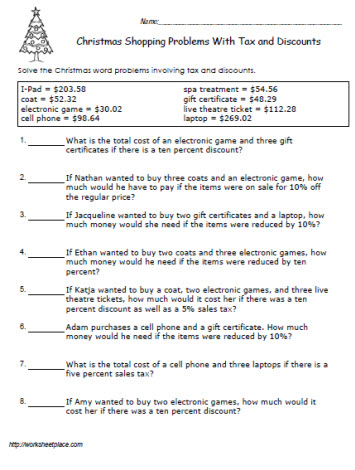

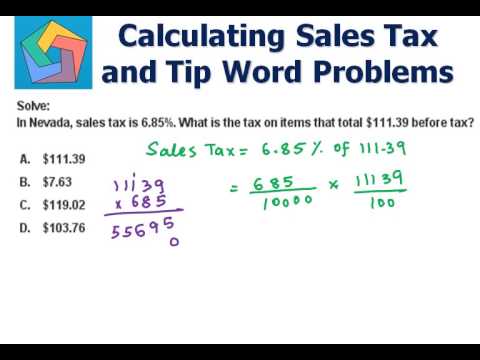

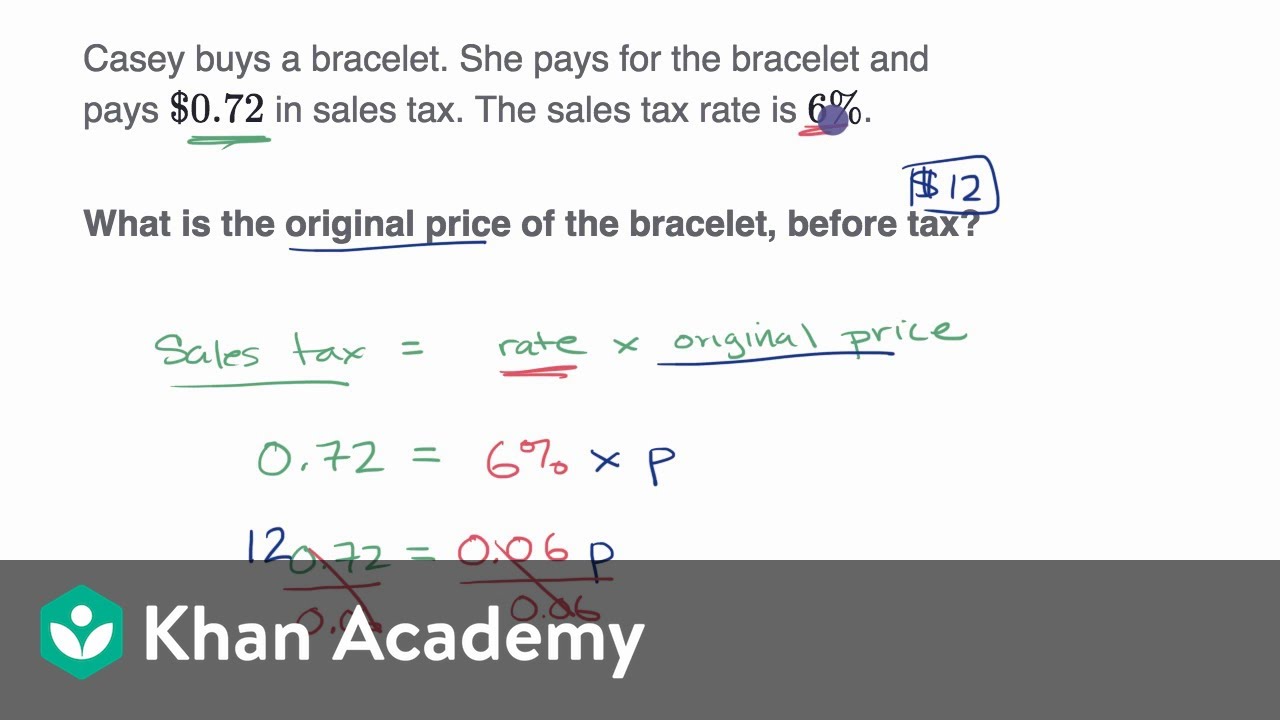

Sales Tax Worksheets - Math Worksheets 4 Kids Find the sales tax and calculate the total cost of the items using these 3-part printable worksheets! Finding the Original Price If the sale price is $460 and the sales tax rate is 4%, what is the original price? All there's to do is to substitute the values in the appropriate formula and proceed to solve for the missing values. Discount Sales Tax Worksheets Teaching Resources | TPT DISCOUNT AND SALES TAX WORD PROBLEM WORKSHEET AND TASK CARDS Page 1: Worksheet (5 problems)Page 2: Solutions and AnswersPage 3: Task Cards (5 problem task cards and 1 answer key card)Each card measures 3.67 (width) by 4.25 (height) inches. All six cards fit on one sheet of letter-size paper (8.5 by 11 inches). Applying Taxes and Discounts - WorksheetWorks.com Applying Taxes and Discounts Using Percentages Find the price of an item after tax and discount These problems ask students to find the final price of various items after discounts and taxes are applied. Copyright © 2002-2022 WorksheetWorks.com All Rights Reserved.

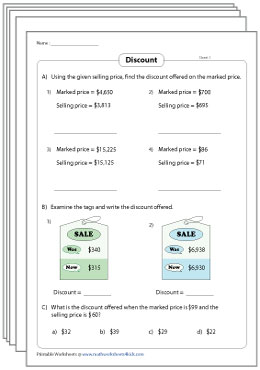

Sales tax discount math worksheets. Discount Worksheets - Math Worksheets 4 Kids Here's the formula: discount percent = discount amount ÷ marked price x 100. Finding Selling Price or Marked Price Using Discount Percent What is the marked price if the selling price is $86 after a discount of 6% is applied? Experience the ease of finding the sale price or marked price in this section of our calculating discount worksheets. Texas Sales Tax Calculator - Tax-Rates.org 6.25%. Texas State Sales Tax. -4.25%. Maximum Local Sales Tax. 2.00%. Maximum Possible Sales Tax. 8.05%. Average Local + State Sales Tax. The Tax-Rates.org Texas Sales Tax Calculator is a powerful tool you can use to quickly calculate local and state sales tax for any location in Texas. WORKSHEET ON DISCOUNT AND SALES TAX - onlinemath4all WORKSHEET ON DISCOUNT AND SALES TAX Question 1 : If marked price = ₹1700, selling price = ₹1540 then find the discount. Solution : Discount = Marked price - Selling price Discount = 1700-1540 = ₹160 Question 2 : If marked price = ₹990 and percentage of discount is 10, then find the selling price. Solution : Discount percentage = 10% Motor Vehicle - Sales and Use Tax - Texas Comptroller of Public Accounts Sales: 6.25 percent of sales price, minus any trade-in allowance. The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value. Texas residents - 6.25 percent of sales price, less credit for sales or use taxes paid to other states, when bringing a motor vehicle into Texas that was ...

Money And Consumer Math Worksheets pdf | Math Champions Free printable math worksheets on expenses calculation are presented on this consumer math worksheet page. This is where kids will learn how to calculate to rationality of the value of money. The first rule to stay rational in spending money should be tightly connected to attributing the right value to what we are spending a certain amount of ... Sales Tax And Discounts Worksheets Teaching Resources | TPT Sales Tax, Tip, and Discount Color-By-Number Worksheet by Eugenia's Learning Tools 4.7 (15) $3.00 PDF This is a color by number worksheet focused on calculating total cost after after calculating sales tax, tip, or discount. The worksheet contains 12 problems. Answer Key provided.Great for basic independent practice or as a station activity. Sales Tax And Discount Worksheets - K12 Workbook Displaying all worksheets related to - Sales Tax And Discount. Worksheets are Sales tax and discount work, Sales tax and discount work, Sales tax practice work, Discount tax and tip, Discount markup and sales tax, How to calculate discount and sales tax how much does that, Taxes tips and sales, Percent word problems tax tip discount. Sales and Use Tax - Texas Comptroller of Public Accounts News and Announcements. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. Local taxing jurisdictions (cities, counties, special purpose districts and transit authorities) can also impose up to 2 percent sales and use tax for a maximum combined rate of 8.25 ...

May 2021 National Occupational Employment and Wage Estimates Mar 31, 2022 · Tax Examiners and Collectors, and Revenue Agents: ... Math and Computer Science Teachers, Postsecondary ... Sales Representatives, Wholesale and Manufacturing: 1040 (2021) | Internal Revenue Service - IRS tax forms If you received any tax-exempt interest (including any tax-exempt original issue discount (OID)), such as from municipal bonds, each payer should send you a Form 1099-INT or a Form 1099-OID. In general, your tax-exempt stated interest should be shown in box 8 of Form 1099-INT or, for a tax-exempt OID bond, in box 2 of Form 1099-OID and your tax ... JPMorgan Chase says it has fully eliminated screen scraping Oct 06, 2022 · JPMorgan Chase has reached a milestone five years in the making — the bank says it is now routing all inquiries from third-party apps and services to access customer data through its secure application programming interface instead of allowing these services to collect data through screen scraping. Discount and Sales Tax Word Problems (solutions, examples, worksheets ... Discount and Sales Tax Word Problems More Lessons for GMAT Math Math Worksheets Examples, solutions, and videos that will help students review word problems on discount and sales tax. Discount Word Problem Finding the full price when you know the discount price Discount and Sales Tax Word problem involving discount and sales tax. Finding Discounts

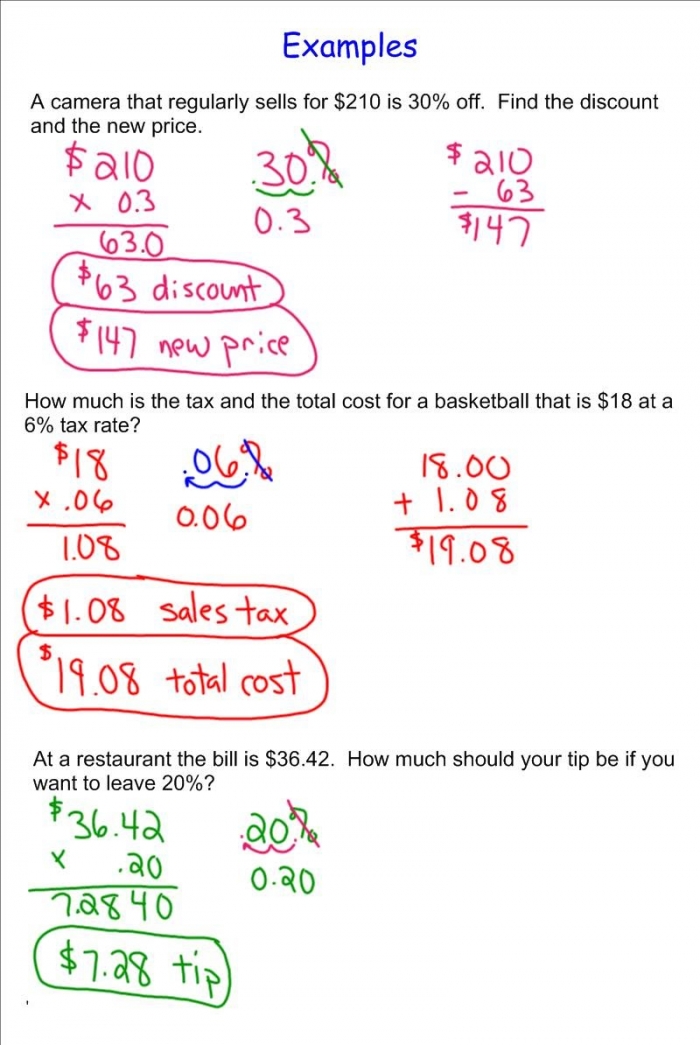

Taxes Lesson Plans, Income Tax Worksheets, Teaching Activities A basic worksheet to help teach young students the concept of paying taxes while practicing basic math. SALES TAX. Discount and Sales Tax Lesson Plan. Students learn about sales tax and discounts. Lesson includes changing percents and calculating total cost. Includes a teaching lesson plan, lesson, and worksheet. Sales Tax Introduction (Level 1)

NCERT Solutions for Class 8 Maths Chapter 8 Comparing Quantities Discount = Discount % of the Marked Price; Additional expenses made after buying an article are included in the cost price and are known as overhead expenses. C.P. = Buying price + Overhead expenses; Sales tax is charged on the sale of an item by the government and is added to the Bill Amount. Sales tax = Tax% of Bill Amount.

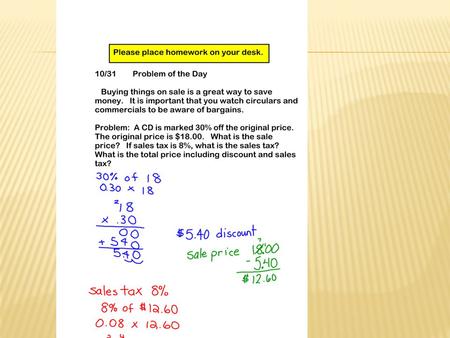

DOC Sales Tax and Discount Worksheet - Chester Sales Tax and Discount Worksheet -Math 6 In a department store, a $50 dress is marked, "Save 25%." What is the discount? What is the sale price of the dress? In a grocery store, a $21 case of toilet paper is labeled, "Get a 20% discount." What is the discount? What is the sale price of the toilet paper?

CCSS.Math.Content.7.RP.A.3 Use Proportional... - Internet4Classrooms Sharing Prize Money - This worksheet uses UK money, but ratios are set up the same way; Sharing Prize Money 2 - This worksheet uses UK money with a profit and loss scenario; Shopping at Troy's Toys - Percent shopping; Simplifying Ratios - How to make ratios smaller so that they are easier to understand

Applying Taxes and Discounts - WorksheetWorks.com Applying Taxes and Discounts Using Percentages Find the price of an item after tax and discount These problems ask students to find the final price of various items after discounts and taxes are applied. Copyright © 2002-2022 WorksheetWorks.com All Rights Reserved.

Discount Sales Tax Worksheets Teaching Resources | TPT DISCOUNT AND SALES TAX WORD PROBLEM WORKSHEET AND TASK CARDS Page 1: Worksheet (5 problems)Page 2: Solutions and AnswersPage 3: Task Cards (5 problem task cards and 1 answer key card)Each card measures 3.67 (width) by 4.25 (height) inches. All six cards fit on one sheet of letter-size paper (8.5 by 11 inches).

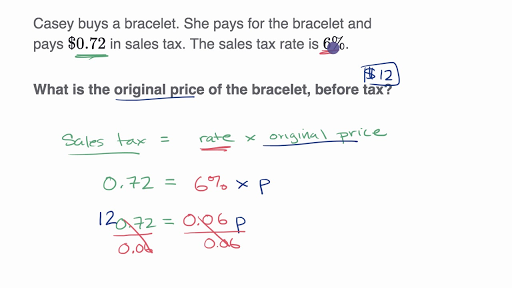

Sales Tax Worksheets - Math Worksheets 4 Kids Find the sales tax and calculate the total cost of the items using these 3-part printable worksheets! Finding the Original Price If the sale price is $460 and the sales tax rate is 4%, what is the original price? All there's to do is to substitute the values in the appropriate formula and proceed to solve for the missing values.

0 Response to "39 sales tax discount math worksheets"

Post a Comment